BLOCKCHAIN FOR CROSS-BORDER PAYMENTS

Want to send money across borders securely? Blockchain may be the best choice.

Have you ever had to send money to someone from another country? Sending money to someone in another country may be slow and expensive, especially if you use services like Payoneer or PayPal. The banking industry, which processes these transactions, is not always efficient. They might be slow to update its processes, resulting in delays and increased expenses for foreign transactions. This is because payments may have to go through several phases before reaching their destination, which adds extra time and money.

But Don’t Worry! There’s got to be a better way, right? That’s where blockchain technology comes in to offer a faster, cheaper and more efficient solution for cross-border payments.

International money transfers are made easier and more efficient with the use of blockchain-based cross-border payment systems. Blockchain technology offers individuals to speed up and reduce the costs of money transfers, as compared to relying on traditional banking systems. As a result, transferring funds to associates in a foreign nation can be accelerated, more cost-effective, and more easily traceable. In general, the objective of blockchain cross-border payments is to enhance the ease and efficiency of worldwide money transactions for everyone.

In this blog we will explore the promises of blockchain for cross-border payments, how well it works, what the benefits are, regulatory considerations and future trends for this. So, get ready to go on a delicious journey with us that will help you in your finance management.

Cross Border Payments

A cross-border payment is when money is sent to another individual or business in another country. This may be you sending money to a friend abroad, a firm purchasing items from a different country, or a bank proceeding funds to a foreign bank. Simply it refers to any transaction in which the sender and receiver are in different countries.

Need and benefits of Cross Border Payments

Cross-border payments provide organisations with a multitude of advantages, such as enhanced payment flexibility, expedited payment processing, enhanced customer satisfaction, entry into international markets, heightened revenue and expansion, cost reduction, and enhanced payment security. Various payment methods are available, such as mobile money, digital wallets, and QR code rapid payments, which contribute to improved cash management and immediate fund accessibility. Additionally, they facilitate the acquisition of new consumers, suppliers, and partners, therefore augmenting competitiveness and attracting new opportunities. The act of engaging in international trade of products and services serves to broaden income streams, hence accessing new possibilities for expansion and expanding client demography. Certain international payment systems offer greater cost efficiency, enabling firms to reduce transaction costs and currency conversion rates. In addition to their core services, payment service providers also incorporate security measures such as PCI DSS Level 1 security and payment compliance, which serve to safeguard cross-border transactions and uphold the reputation of businesses.

Cross border payment with Blockchain Technology

When employing blockchain technology for international payments, transactions may be started by users of the network or they can be triggered automatically by smart contracts depending on particular parameters. After then, the particulars of the transaction are transmitted to a network of computers, known as nodes, for verification. To reach an agreement about the legitimacy of the transaction, these nodes employ a particular approach known as the consensus protocol. The transaction is added to the blockchain once it has been validated, which ensures that the blockchain is both secure and transparent.

Blockchain Vs Traditional Cross-Border payments

| Aspect | Blockchain Cross-Border Payments | Traditional Cross-Border Payments |

| Speed | Faster and efficient | Slower and inefficient |

| Cost | Lower costs | Higher costs |

| Security | High security with cryptography | Security relies on intermediaries |

| Transparency | Transparent with transactions recorded on a public ledger | Less transparent with limited visibility into transaction process |

| Accessibility | Accessible to anyone with internet | Accessibility depends on banking infrastructure |

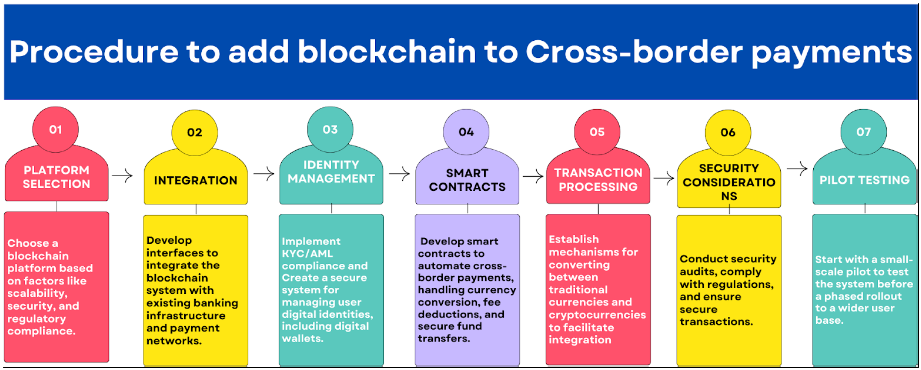

Procedure to add blockchain to Cross-border payments

Blockchain Cross-Border payments benefits and use cases

Blockchain technology is being employed in a variety of sectors for the purpose of making international payments. This technology offers a number of benefits: Let’s Explore with me five important examples of use cases:

- Remittances: Blockchain facilitates faster and cost-effective remittance transactions, enabling users to transfer funds to relatives and friends in other countries with lower fees and in faster processing timeframes.

- International Trade: Blockchain technology facilitates international trade by offering safe and transparent payment solutions, therefore mitigating the potential for fraudulent activities and optimising the payment procedure between buyers and sellers across multiple countries.

- Supply Chain Finance: It is made easier by blockchain technology, which enables payments to be made between suppliers, manufacturers, and distributors across international boundaries in a transparent and secure manner. This results in increased efficiency and reduced expenses.

- Peer-to-Peer Payments: Due to the fact that blockchain technology permits direct peer-to-peer payments across borders without the need for intermediaries, it enables individuals to do business with other people all over the world in a way that is both safe and cost-effective.

- Cross-Border E-commerce: The use of blockchain technology makes it possible for international e-commerce platforms to provide clients all over the globe with payment options that are both safe and efficient. This improves the overall shopping experience and broadens the market reach of enterprises.

Some other Examples of Blockchain Cross-Border payments:

-

- Ripple (XRP): Fast and cheap international money transfers are made possible by Ripple using blockchain technology. Its network links financial institutions all around the globe, enabling the settlement of cross-border transactions to happen very instantly.

- Stellar (XLM): By making international money transfers easy, cheap, and accessible, Stellar is working to expand people’s access to formal financial services. It facilitates cross-border money transfers for people and companies using its cryptocurrency, XLM, which acts as a bridge between several currencies.

- SWIFT Global Payments Innovation (GPI): Using blockchain technology, SWIFT Global Payments Interface (GPI) is a system that allows quicker and more transparent international payments. It allows for the monitoring of payments in real time and guarantees that the cash will be credited to the account of the receiver as soon as possible.

- BitPesa: BitPesa facilitates cross-border payment processing for African companies via a blockchain-based platform. In comparison to more conventional banking options, it employs Bitcoin as its means of trade and provides cheaper costs.

- Coins.ph:You may send and receive cryptocurrency across borders with Coins.ph, a blockchain-based payment network. It is a great choice for remittances because of the minimal costs and quick transactions it provides.

Challenges to Blockchain Cross-Border Payments

In the realm of cross-border financial transactions, the use of blockchain technology faces a number of challenges such as regulatory uncertainty, compliance issues, scalability limitations, interoperability between platforms, and the volatility of cryptocurrencies.

The future of blockchain cross-border payments holds exciting opportunities. Let’s look at some future trends:

Central Bank Digital Currencies (CBDCs)

Governments are looking into CBDCs as digital representations of national currencies, which are expected to simplify cross-border transactions while retaining regulatory oversight.

Stablecoins and Tokenization

Stablecoins bound to fiat currencies provide stability in cross-border payments, whereas asset tokenization promotes commerce by representing real-world assets on blockchain networks.

Decentralized Finance (DeFi)

DeFi systems are evolving to include cross-border payment options, allowing users to lend, borrow, and trade without relying on traditional banks.

Conclusion

Blockchain cross-border payments provide interesting prospects to improve how we proceed payments internationally. Blockchain cross-border payments have the potential to make international money transfers as simple as sending a text message. They constitute a huge advancement in global finance, pointing to a future in which borders are no longer challenges to financial activities.In this blog, we’ve looked at how blockchain have the potential to transform the way of transferring payments across borders.

Stay with us, if you want to know more about blockchain technology….