WHY INDUSTRIES ARE ADOPTING BLOCKCHAIN?

Blockchain is essential for industries, it establishes trust, enhances security, improves efficiency, and fosters innovation. It offers a reliable foundation for diverse sectors to optimize processes and explore new opportunities. Here are some industries adopting blockchain to secure a better future:

|

|

|

|

|

|

|

|

|

|

|

|

Banking

Blockchain technology has the potential to transform the banking sector. By 2025, it’s projected to hold 10% of the global GDP, signaling a profound impact. The industry’s market size is anticipated to reach $20.03 billion by 2024, underscoring significant growth. In 2020, 14% of financial institutions had embraced blockchain, marking a gradual shift in the sector. The potential for blockchain to reduce compliance costs by 50% and save banks $8-12 billion annually highlights its efficiency. Major banks are deeply engaged, with 90% exploring blockchain, which is regarded as the future by 65% of banking experts. (zipdo, 2023)

Why do we need advancement in Banking system?

In a traditional banking system, transactions are recorded on centralized ledgers maintained by banks and financial institutions, relying on intermediaries like banks, clearinghouses, and payment processors for validation. This setup involves legacy IT infrastructure and multistage verification, leading to slow cross-border payments. The traditional system leads to high costs due to physical branch maintenance, compliance, and a sizable workforce. While it implements robust security measures, vulnerabilities to fraud, data breaches, and operational errors. Advancements in the banking system are essential to keep pace with evolving consumer needs, technology, and global economic trends. A modernized banking system fosters financial inclusion by providing services to underserved populations, boosts economic growth by facilitating investments and lending, and supports a more interconnected global economy. In a rapidly changing financial landscape, continuous advancements in the banking sector are imperative to meet the evolving demands of businesses and individuals and to promote overall economic development.

How to use blockchain in Banking?

Integrating blockchain technology into the banking sector offers numerous benefits. Let’s explore how blockchain is facilitating the global banking system:

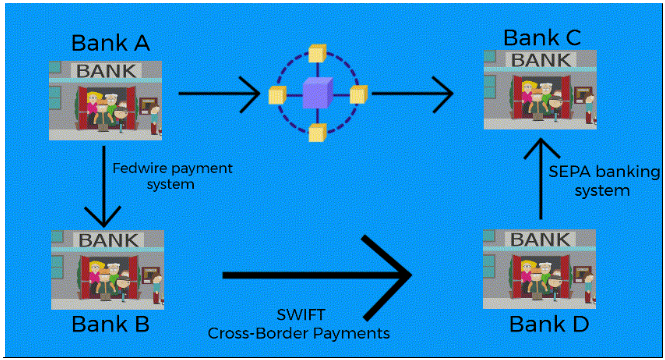

Cross-Border Payments

Incorporating SWIFT and Fedwire payment systems into blockchain-based cross-border payments enhances the process’s efficiency. It commences at the sender’s bank (Bank A), utilizing blockchain for secure and efficient transactions while concurrently generating SWIFT or Fedwire messages for compatibility with traditional financial networks. The blockchain network validates and records transactions, enabling real-time communication with the SWIFT or Fedwire infrastructure. Intermediary banks (Bank B and Bank C) ensure compliance and verification, aligning with both blockchain and legacy systems. The recipient’s bank (Bank D) credits the amount upon verifying compliance. So, Blockchain facilitates cross-border payments by enabling direct peer-to-peer transactions, ensuring rapid settlements in minutes, reducing expenses through fewer intermediaries, improving transparency, and enhancing security.

Smart contract

In smart contracts for banking on the blockchain, banks create digital agreements, deploy them on the blockchain, and set trigger conditions. When triggers are met, contracts execute automatically, ensuring transparency and security while reducing operational costs, making financial agreements efficient.

Digital verification

In banking, blockchain technology creates a secure network for digital identification verification, connecting consumer accounts to validated KYC data. Personal information is securely kept on the blockchain and is authenticated using cryptographic credentials. Smart contracts reduce verification procedures, while user training and transparency boost security. This approach enhances banking security, efficiency, and trust.

KYC (Know Your Client)

Know Your Customer (KYC) is a critical process in the banking industry to verify the identity of customers and ensure compliance with various regulations. Blockchain technology has the potential to streamline and enhance the KYC process by providing a secure and immutable way to store and share customer information. How can KYC be implemented in banking using blockchain?

Data Collection and Verification:

When a customer applies for a bank account or financial service, the bank collects their personal information and documentation, such as passports, utility bills, and financial records. This data is then verified against trusted sources.

Creation of a Digital Identity:

The customer’s verified information can be used to create a digital identity on the blockchain. This identity is encrypted, and access is controlled through cryptographic keys, ensuring the security and privacy of the customer’s data.

Management:

Customers should have control over who can access their KYC data. Blockchain can provide a mechanism for customers to grant consent for specific entities to access their KYC information

Data Sharing:

Banks and other financial institutions can share KYC information with each other through a permissioned blockchain network. This eliminates the need for customers to repeatedly provide the same information to different institutions, reducing redundancy and improving efficiency.

Regulatory Compliance:

The immutable nature of blockchain ensures that customer data remains unchanged and can be audited at any time, making it easier to comply with regulatory requirements. Regulators can also have controlled access to this network to monitor compliance in real-time.

Security and Privacy:

Blockchain technology provides strong security through cryptography, reducing the risk of data breaches.

Cost Reduction:

By eliminating duplicative efforts and reducing the need for manual data entry and verification, blockchain can significantly reduce the cost associated with the KYC process.

Customer Onboarding:

The KYC process can be streamlined, making it quicker and more convenient for customers to open accounts or access financial services.

Continuous Monitoring:

Blockchain can also support continuous monitoring of customer information, allowing banks to update KYC information in real-time as necessary, and keeping a history of changes.

Data storage and sharing

The top priority in banking revolves around the secure storage of account information and transaction records while maintaining the swift accessibility of this data when required. Blockchain technology in the banking sector significantly heightens data security and operational efficiency. It establishes an unalterable ledger spread across multiple nodes, ensuring that data remains tamper-resistant. Sensitive information receives an additional layer of security through encryption. Access is restricted to authorized parties via permissioned blockchains, with smart contracts automating data sharing based on predefined guidelines. Customer data control is achieved through consent management. Cryptographic keys provide an additional safeguard, and data exposure is minimized. Blockchain bolsters regulatory compliance with real-time audit capabilities, streamlining processes to reduce redundancy, while standardized data formats ensure uniformity. It allows for real-time data updates, preserving customer privacy and aligning with regulatory requisites.

What are the limitations of Blockchain Implementation in the Banking Sector?

Blockchain integration in banking faces hurdles like regulatory complexities, scalability issues, data privacy concerns, smart contract risks, high initial costs, and environmental impacts, challenging its widespread adoption.

Can we consider Blockchain-Powered Future of Banking?

The decentralized nature of blockchain reduces reliance on intermediaries, which can lead to cost savings and more inclusive financial services. However, challenges like regulatory compliance and scalability need to be addressed. With continuous advancements and regulatory frameworks evolving, it’s plausible that blockchain will play a pivotal role in shaping the future of banking, offering a more secure, efficient, and accessible financial ecosystem.

Blockchain technology offers enhanced security, efficiency, and transparency, making it a transformative force in the banking sector. While challenges exist, including regulatory complexities and scalability issues, the momentum toward blockchain adoption is unmistakable. The advantages, such as reduced costs, faster cross-border payments, and improved data security, underscore its importance in shaping the banking sector’s future. As technology evolves and regulatory frameworks mature, the possibility of a blockchain-powered future in banking becoming a reality is not only worth considering but increasingly likely, promising a more interconnected, efficient, and inclusive financial landscape.